Rates are falling, listings are rising — but the story isn’t the same for every home type. Here’s what you need to know.

🔍 By the Numbers: March at a Glance

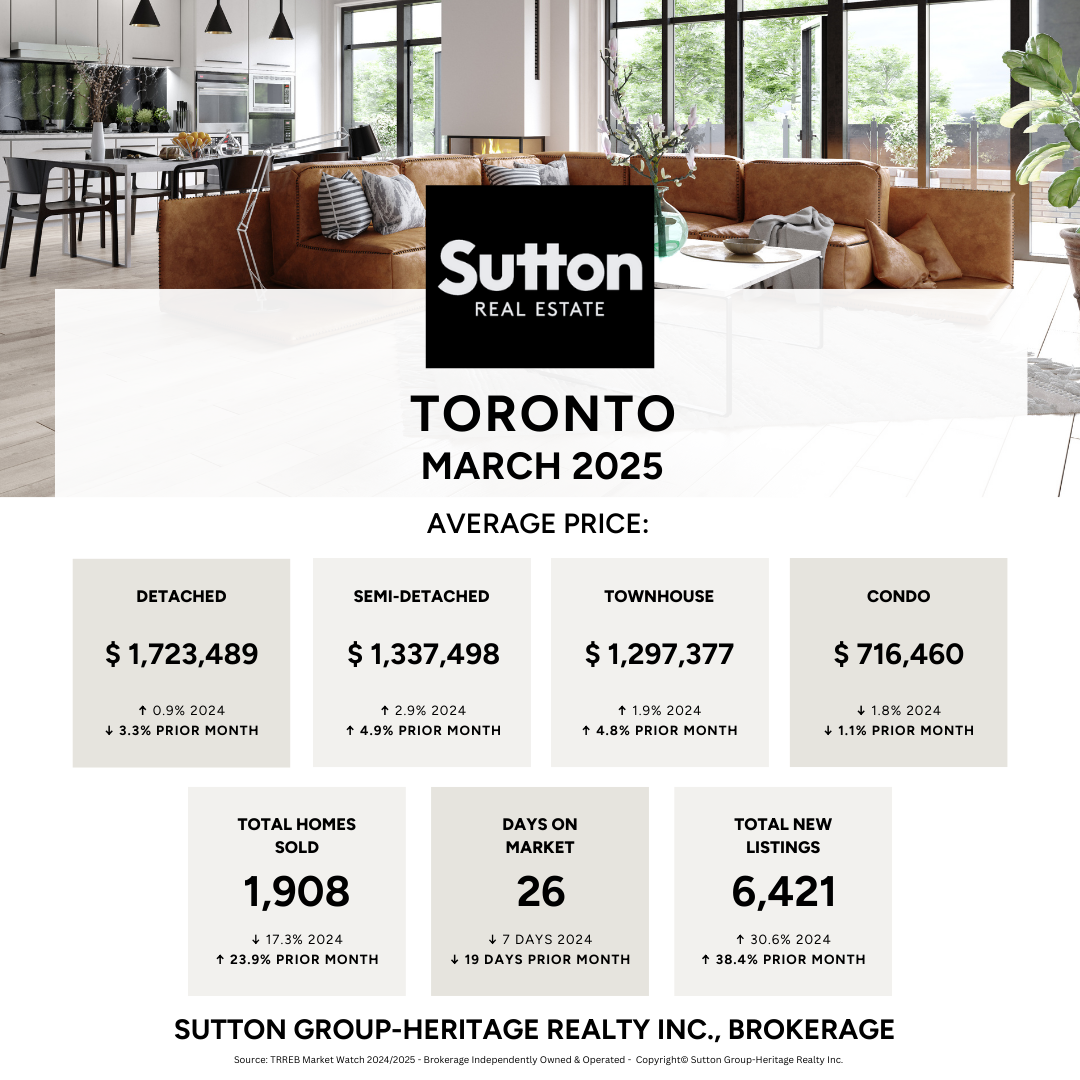

Total Sales: 5,011 (-23.1% YoY, +24.1% MoM)

Average Selling Price: $1,093,254 (-2.5% YoY, +0.8% MoM)

New Listings: 17,263 (+28.6% YoY)

Active Listings: 23,462 (+88.8% YoY)

Days on Market:

Property DOM: 25 days (-13.8% YoY, -41.9% MoM)

Listing DOM: 24 days (+20% YoY, -14.3% MoM)

🧠 Top Takeaway: While sales have decreased compared to last year, the month-over-month increase suggests a seasonal uptick. However, the significant rise in new and active listings indicates a shift towards a more balanced market, with increased options for buyers.

What's happening locally? Durham & Toronto Market Insights

Every city/town is unique as are the communities within them. Scroll through to find your town.

📉 Rates Down, Caution Up: The Interest Rate Picture

On March 12, 2025, the Bank of Canada reduced its policy rate by 25 basis points to 2.75%, marking the seventh consecutive rate cut since June 2024. This move aims to counteract economic uncertainties, particularly those arising from ongoing trade tensions. Source

📈 Current Trends:

BoC Rate: 2.75%

5-Year Fixed Averages: Approximately 3.79%-4.50%

Variable Rates: Around 4.24-4.79%

Bond Yields: Declining, reflecting market reactions to economic uncertainties Source

🏠 What’s Changing — and What’s Not

1. Sales Rebound or Seasonal Bump? Sales have increased by 24.1% month-over-month, suggesting a seasonal rise as we enter the spring market. However, the 23.1% year-over-year decline indicates that buyers remain cautious amid economic uncertainties.

2. Freehold Homes Gaining Ground Detached and semi-detached homes are experiencing stable prices with slightly rising demand, particularly in areas like Mississauga, where average prices have increased by 2.8% year-over-year. While in Durham Region Detached homes got slightly more affordable as inventory outpaced sales and pricing declined in most markets. Source

3. Condos Facing Headwinds The condo market remains in a buyer’s market, with a significant increase in inventory. Approximately 31,000 new condo units are expected to be completed in 2025, further increasing available inventory. Source

4. Market Uncertainty Clouds Outlook Ongoing trade tensions and recent tariff implementations have introduced economic uncertainties, impacting consumer and business confidence. The Bank of Canada has highlighted concerns about potential disruptions to economic growth and inflationary pressures. Source

🗣️ Expert Insight: “The significant increase in new listings provides buyers with more options, but also indicates that sellers are eager to enter the market amid economic uncertainties.” — TRREB’s Chief Information Officer Jason Mercer

⚖️ Buyers vs. Sellers: Who Has the Edge Right Now?

For Buyers:

More choice due to increased inventory

Favourable borrowing conditions with recent rate cuts

Leverage in negotiations, especially in the condo market

For Sellers:

Need for realistic pricing to attract cautious buyers

Enhanced property presentation to stand out in a crowded market

Patience required, as increased listings mean longer selling times

🔮 Quick Verdict:

📞 Need Help Navigating This Market?

With the market shifting month by month, strategic advice is more important than ever. Whether you're planning to buy, sell, or just assess your options, our team is here to help you make confident decisions.

👉 Let’s connect — no pressure, just clarity.

.png)

Comments:

Post Your Comment: